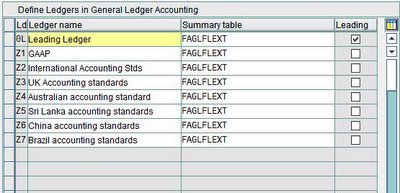

First we have to define the ledgers according to the number of standards on which we have to maintain the accounts. For maximum flexibility we can define one ledger per standard. But always consider the fact that we are going to duplicate the database entries per ledger for each double entry. So I advise that if you feel that there are standards which are pretty similar, use only one ledger for those similar standards.

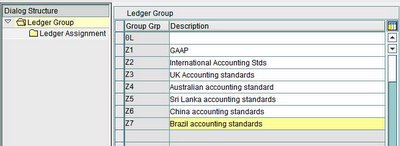

There should be at least one leading ledger. Along with that we can define any number of non leading ledgers to satisfy our needs. When we define ledgers, system will automatically create ledger groups on a one to one relationship to the ledgers.

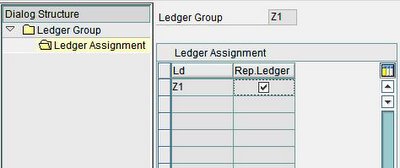

A ledger group is a combination of ledgers for the purpose of applying the functions and processes of general ledger accounting to the group as a whole. When posting, for example, we can restrict the update of individual postings to a ledger group so that the system only posts to the ledgers in that group. We can group the ledgers into the ledger groups with a representative ledger from which the system will determine and check the posting periods for that ledger group during postings.

After we have defined the ledgers we can specify the parallel currencies on which we want to maintain the accounts on leading and non leading ledgers for each company code. You can have up to three currencies per ledger per company code. But the non leading ledgers can only be maintained on the currencies that specified for leading ledger. But note that you don’t have to maintain non leading ledgers on all leading ledger currencies.

Another interesting functionality is that you can even specify different fiscal year and posting period variants to the company codes for the non leading ledgers than the leading ledger.

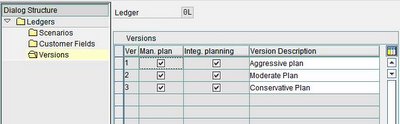

Even we can control how other components like ‘Cost Center’, ‘Consolidation’, ‘Business Area’, ‘Profit Center’, ‘Segmentation’ and ‘Cost of Sales Accounting’ will update the ledger by assigning the necessary scenarios to ledgers. A scenario determines which fields are updated when postings are received from other application components. We cannot define our own scenarios. For example we may only update the leading ledger with the cost center details while keeping the other ledgers untouched. This gives the ultimate flexibility to manage the trade off between the database performance and the financial information requirements.

We can add additional fields to the summery table and capture information that cannot be captured by the existing fields on the summery table FAGLFLEXT. Again we can assign the fields to the ledgers like we do to the scenarios as I explained above. I’ll talk about how we can assign additional fields to the summery table FAGLFLEXT on a different post.

My SAP financial even allows us to maintain multiple planning versions per ledger. For example we can use scenario planning techniques by defining different planning versions for individual ledgers which I feel really useful to the managers on this highly unpredictable business environment.

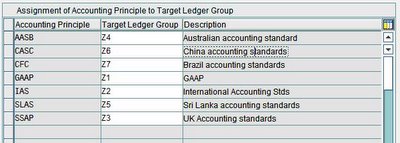

After we defined the ledgers and the ledger groups we can define the accounting principles on SAP system and assign them to the ledger groups.

Once we have carried out the above activities the next step would be to create the accounting document types and their number ranges for entry view. The important point I want to stress at this time is that we have to define number ranges for the accounting documents specific to the non leading ledger groups too. And we cannot use the same number range object we used for the leading ledger. The reason is when we post documents to a specific ledger group if we have the same number range assignment as leading ledger; it will create number gaps on the leading ledger accounting documents. So system will not allow you to specify the same number range object of leading ledger to be assigned to the non leading ledgers.

When it comes to Document types for general ledger view, we don’t have to do anything for leading ledger since in the case of this ledger, the document number in the entry view always corresponds to the document number in the general ledger view. We only have to make these settings for any non-leading ledgers that have a fiscal year variant that differs in at least one company code from the fiscal year variant of the leading ledger in this company code. In this case, the document number in the entry view does not correspond to the document number in the general ledger view and we have to define a separate document type with document number assignment for the general ledger view.

These are the basic settings that we have to do in order to carry out parallel accounting on MySAP Financials. Now we can use transaction codes FB50 and F-02 to post double entries into all the ledgers and transaction codes FB50L and FB01L to post double entries to selected ledger groups. We can generate the financial statements per ledgers when we need them.

This is a basic idea about how we can configure parallel accounting on MySAP Financials and hope that this post has given you a good idea about some of the new SAP general ledger functionalities. Please feel free to send me a comment.

11 comments:

Thanks a lot!!!

This gave me a good overview and pratical approach on how things are working with the New G/L!

Nice work!

Mathieu.

Grt Help....Thanx a lot!

dd

Great n Keep up the good work...

www.ficodotcom.blogspot.com

www.tamulan.blogspot.com

Hi,

We have 2 ledgers. One leading ledger with 12 periods and one non-leading ledger with 24 periods. Can we give the cost center and cost element planning data as per the non-leading ledger periods? Can any body clarify on this? Thanks in advance.

Rajesh Jade

I use BAPI_ACC_DOCUMENT_POST for FB50 but I can't use it for FB50l because the ldgrp is not available there. Do you know if there is an alternative for this?

I did not find in SPRO in New GL the place where you define per ledger the number ranges. I only see that for entry view and GL view you can enter number ranges separately?!

Hey Shathees,

information is extensive and very informative!! Well done as always! One Question for you....can this leading ledger be implemented for the 4.7 version too.. or is this specific ONLY for ECC.

We are trying to recreate a new company code in order to introduce a parallel currency.. what do you think?

Thanks much!

Rukshana

Thumbs up guys you are really carrying out a great job. Accounting firms in Toronto

The complete blogs are really inconceivable and definitely everyone will share this information.

Accountants in Toronto

IEEE Final Year projects Project Centers in India are consistently sought after. Final Year Students Projects take a shot at them to improve their aptitudes, while specialists like the enjoyment in interfering with innovation. For experts, it's an alternate ball game through and through. Smaller than expected IEEE Final Year project centers ground for all fragments of CSE & IT engineers hoping to assemble. IEEE Project Domains It gives you tips and rules that is progressively critical to consider while choosing any final year project point.

JavaScript Online Training in India

JavaScript Training in India

The Angular Training covers a wide range of topics including Components, Angular Directives, Angular Services, Pipes, security fundamentals, Routing, and Angular programmability. The new Angular TRaining will lay the foundation you need to specialise in Single Page Application developer. Angular Training

Maintaining financial accounts with MySAP is simple, and this guide explains it very well. I appreciate your efforts in writing this valuable post, keep sharing your knowledge and such educational posts. As a firm providing Accountancy service in Rugby, UK, I am glad to discover this blog. Thank you for sharing this.

Post a Comment